Domestic banks not lack of liquidity

移动用户编辑短信CD到106580009009,即可免费订阅30天中国日报双语手机报,第一时间获取世界杯赛事双语动态。

The second step is to mobilize private capital into banks: Encourage private capital to invest and participate in restructuring financial institutions; allow the development of mature and steady village banks; adjust the capital ratio of the mainline and other shareholders at the lowest ratio requirement; and allow private banks at their own risks by private capital to try getting into private financial institutions such as renting companies, consumer finance companies.

The third step is to promote specialized development of non-banking financial institutions: Continue to push forward trust companies’ intensified mechanism reform to better display the functional advantage of trust in the emerging property right system, social livelihood area and wealth management aspects; promote the high-connect between social capital and quality projects; encourage financial renting companies to moderately expand scope of lease business; actively develop a full set of equipment and assets project financial lease business; promote the adjustment of technological innovation and industrial structure; optimize enterprise group finance companies’ access standards, strengthen internal management, support enterprise groups improve development quality, and facilitate the upgrade of industrial structure.

Secondly, improve the banking service system which is close to the market and able to cure the real economy: Seize firmly the significant strategic opportunity brought to China’s banking industry by industrialization, urbanization, informatization and agricultural modernization. Firmly establish a customer-focused service concept; complete the modern banking system to provide real economy with specified, sustainable and high value-added financial services.

The first step is to utilize trust lever to facilitate industrial structural adjustment. More trust support should be offered to promising advanced manufacturing industry, strategic emerging industry, modern information industry, information consumption & high-end service industry and environmental friendly industry to actively cultivate new industrial growth point. According to the CPC’s “four batch” requirements, differentiated credit policies should be implemented to industries with excess capacity respectively, depending on individual cases, to promote the adjustment of excess capacity.

The second step is to develop consumer finance to boost consumption upgrade. We will speed up the improvement of bank card consumption service function, optimize bank card consumption environment, expand the bank card usage scope of urban and rural residents, gradually enlarge the scope of consumer finance companies’ pilot cities, and strive to cultivate new consumption growth points. Innovate product service according to the consumption characteristics of groups such as migrant workers, improve the matching degree and adaptability of financial services to promote consumption upgrade.

The third step is to innovate service mechanism to improve service efficiency. Support banks and network telecom operators to carry out high level intensified cooperation. Innovate service mode, service channel and business products. With the help of internet technology, further strengthen comprehensive service functions such as payment, settlement, financing and consulting. Spread institutions and outlets to lower levels and innovate mechanism and products. According to the characteristics of small and micro emerging agricultural management main bodies and produce wholesalers, develop specified financial products and services, attach more importance to the convenience of financial services, and support enterprises to go out.

Thirdly, improve the financial market system in division of labor, cooperation and coordinated development. Lay stress on revitalizing the stock, well using increment and improving social capital efficiency to increase the ratio of direct financing and gradually form a well structured coordinately developed financial market system where direct financing and indirect financing are complementary. Banking industry, as a major participant of China’s financial market, should play a dominant role in the construction of financial Market system.

The first step is to regulate the development of financing. We need to fully utilize the banks’ technological, network and personnel advantages to classify financing business into direct financing business within the creditors’ type and constantly explore new mode and product for financing businesses to serve real economy.

The second step is to promote normalized development of securitization of credit assets. Support the development of securitization of credit assets, vitalize credit stock, and further develop its function of promoting economic structural adjustment.

Fourthly, improve the well risk-control, efficient operation management system. Promote the development of a comprehensive risk management system in banking industry and financial institutions, improve the level of management and operation, give full play to the role of risk management as the first line of defense, and stick to the bottom line of without systematic and regional risk.

Recently, some international institutions and industrial professionals expressed concerns to the risks in aspects of Chin economic growth, local debts and real estate. It should be noted that these risks are just some side effects in the process of slowing down, development, transformation and institutional transition of China’s economy. As long as the risks re sufficiently realized and correct risk management measures are taken, the risks are manageable.

精彩热图

新闻热搜榜

24小时新闻排行

独家策划

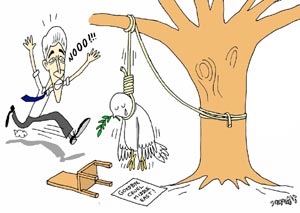

当晚,加沙遭到以色列陆海空三面炮击,唯一一座发电站被炸毁,造成至少60名巴勒斯坦人死亡,加沙可谓经历了史上最沉重的一夜。

详细>>精彩推荐

- [新片] 苏有朋否认奶茶妹妹演《左耳》 已找到"小耳朵" 影片即将开拍

- [秀爱] 贝克汉姆夫妇结婚15年 贝嫂收夫13枚婚戒

- [明星] 碧昂斯演唱会粉丝自拍 米歇尔与2女儿入镜

- [预告] 《加勒比海盗5》将于2017年7月7日上映

- [电影] 电影咖组团进荧屏 美剧开启高大上模式

- [电影] 《霍比特人3》曝剧情 五军上演史诗生死大战

- [译名] 台媒称《变形金刚》内地译名俗气内地反击

- [电影] 《霍比特人3》将曝先行预告 正式版10月发布